Content By: Associates, YPF Economics and Employment Policy Team

Sri Lanka ran out of foreign currency after the 2009 civil war and now imports $3bn more than it exports annually. After the end of the civil war in 2009, the economy grew at an average of 6.4 percent between 2010 and 2017, spurred along by a debt driven and increasingly inward-oriented economic model. The country experienced a political crisis in 2018 and then the Easter bombings in 2019.The COVID-19 pandemic exerted a profound, long-lasting impact on output, the labor market, and poverty. As a result, Sri Lanka’s economy contracted by 3.5 percent in 2020 – the worst performance on record. The collapse of the tourism sector also exerted significant pressure on the balance of payments.

In April 2021, President Rajapaksa announced an immediate ban on fertilizers, herbicides and pesticides. These actions decimated the crops of Sri Lankan farmers and contributed to what was an already growing food shortage.The 2022 situation in Sri lanka: food, medicine, fuel shortage, 500,000 people under the poverty line, rise of commodity prices, political upheaval.Severe mistakes made by the dominant Rajapaksa govt:

‣ Undertaking vanity infrastructure projects

‣ Ban on fertilizers and pesticides resulting in an acute food shortage

‣ Dependence on debt finance

‣ China lending a deadly hand, the explosion in borrowing

The economy was already showing signs of important structural weakness before the pandemic. Sri Lanka has one of the lowest tax revenue-to-GDP ratios in the world, reflecting a decline from 24.2 percent in 1978 to 11.2 percent in 2014. While expenditures have not been high (on average 18.4 percent of GDP per year in the last decade), interest cost has been rising.Continued monetization of fiscal deficits and episodes of loose monetary policy created further macroeconomic imbalances. These imbalances, combined with pre-Covid19 tax cuts in 2019, contributed to unsustainable debt and, as a result, Sri Lanka lost access to international financial markets in 2020 due to credit rating downgrades.

Despite rising foreign financing needs, an overvalued exchange rate, increasing trade and investment barriers, and a complex business environment created an anti-export environment, slowing down the growth of export earnings. In 2021, the interest cost was 30 percent of the total expenditure and was equivalent to 72 percent of revenues. As a share of GDP, the public and publicly guaranteed (PPG) debt rose from 78.6 percent in 2017 to 109.7 percent in 2021. As a result, Sri Lanka became one of the most highly indebted developing nations (86th percentile).

Recently, the Ukraine crisis and rising global commodity prices have added additional pressure on the import bill in 2022. As 2022 began the situation in Sri Lanka appeared bleak, with inflation rates soaring and commodity prices rising to unprecedented levels. The country was experiencing food, medicine and fuel shortages as well as daily blackouts with 500,000 people fallen below the poverty line.The Rajapaksa governments have dominated Sri Lankan politics for two decades and have been characterized by widespread accusations of financial mismanagement, corruption, nepotism and authoritarianism.The government has also been accused of undertaking massive vanity infrastructure projects, which see almost no operational usage and generate no revenue despite costing the country billions.

Weak export competitiveness has been hampering Sri Lanka’s export growth for two decades. The ratio of trade to GDP falling from 88 percent in 2000 to 39 percent in 2020. During the same period, exports as a share of GDP fell from 39 to 17 percent.

The World Bank estimates Sri Lanka’s missing exports at US$ 10 billion annually, almost as high as the current level of merchandise exports. The increasing gap between actual and potential exports is driven by a combination of an overvalued real exchange rate and trade policy frictions that increase costs of trading, as well as the benefits of selling domestically

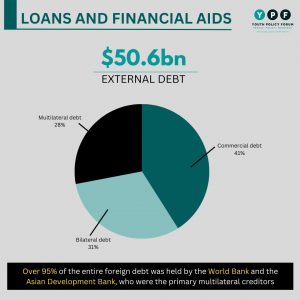

𝗘𝘅𝘁𝗲𝗿𝗻𝗮𝗹 𝗗𝗲𝗯𝘁𝘀 𝗮𝗻𝗱 𝗙𝗶𝗻𝗮𝗻𝗰𝗶𝗮𝗹 𝗔𝗶𝗱𝘀

The nation has been trapped in a debt cycle since 2007.In March 2023, Sri Lanka’s external debt amounted to 50.6 billion dollars.The Sri Lankan government claims that as of March 2023, commercial debt accounted for a sizeable 41 percent of the total external debt of the Central Government, followed by bilateral debt (31 percent), and multilateral debt (28 percent). International Bond Issuances (ISBs) made up about 85% of the debt in the Commercial sector, and Term Financing Facilities (Syndicated Loans) accounted for the remaining 15%. Over 95% of the entire international debt was held by the World Bank and the Asian Development Bank, who were the primary multilateral creditors. In terms of bilateral debt, 40% of its debt is held by Paris Club countries and 60% is held by non-Paris Club nations. Here:Non Paris Club (NPC)- China, India, Saudi Arabia, Kuwait, Hungary, Iran, Pakistan Paris Club (PC)- Japan, France, Korea, Germany, USA, Spain, Russia, Sweden, Australia, Canada, Austria, UK, Belgium, Denmark, Netherlands.

The biggest bilateral lender to Sri Lanka is China, followed by India. Over the past ten years, China has provided Sri Lanka enormous sums of money for roads, ports, airports, and a coal-fired power facility, particularly under the Belt and Road Initiative (BRI).The Export-Import Bank of China has pledged to back Sri Lanka’s efforts to obtain a nearly $3 billion loan from the International Monetary Fund and has given a two-year moratorium on the country’s debt. According to IMF data, Sri Lanka owed China EximBank $2.83 billion by the end of 2020, representing 3.5% of the island’s foreign debt.Sri Lanka owed Chinese lenders a total of $7.4 billion, or nearly a fifth of public external debt, by end of 2022.The International Monetary Fund’s executive board has granted a $3 billion loan to Sri Lanka to help the country get through the financial crisis that has kept it mired in an ongoing political and economic crisis for more than a year.As soon as China agreed to a two-year suspension of Sri Lanka’s debt obligations, the situation began to improve. One other positive turn: Tourist arrivals devastated by the pandemic are recovering even more quickly than anticipated, back up to an expected 1.5 million this year (before the pandemic, roughly two million visited the country). In 2021, Bangladesh granted a loan of $200 million from its foreign reserves to help Sri Lanka recover from the crisis in its economy.To tackle the severe economic crisis, the loan was obtained two years ago using a currency-swap method.The island nation has currently repaid all of the total amount it borrowed from Bangladesh for 2021.

𝗥𝗲𝗰𝗼𝘃𝗲𝗿𝘆 𝗼𝗳 𝘁𝗵𝗲 𝗘𝗰𝗼𝗻𝗼𝗺𝘆 𝗮𝗻𝗱 𝗪𝗮𝘆 𝗙𝗼𝗿𝘄𝗮𝗿𝗱

Sri Lanka requires wide-ranging economic reforms for long-term sustainable growth to service its debt obligations and to emerge from this crisis stronger.The following things will help Sri Lanka on its path to recovery:

𝗦𝗵𝗶𝗳𝘁𝗶𝗻𝗴 𝘁𝗼 𝗠𝗼𝗿𝗲 𝗣𝗿𝗼𝗱𝘂𝗰𝘁𝗶𝘃𝗲 𝗮𝗻𝗱 𝗢𝘂𝘁𝘄𝗮𝗿𝗱- 𝗟𝗼𝗼𝗸𝗶𝗻𝗴 𝗘𝗰𝗼𝗻𝗼𝗺𝘆: With a GDP of around $80 billion, trying to produce many products entirely in Sri Lanka for the Sri Lankan market means reduced economies of scale, resulting in products that are of lower quality and/or higher prices. Shifting the country toward an export-oriented economy should be the goal.

𝗧𝗿𝗮𝗻𝘀𝗳𝗼𝗿𝗺𝗶𝗻𝗴 𝗘𝗰𝗼𝗻𝗼𝗺𝗶𝗰 𝗚𝗼𝘃𝗲𝗿𝗻𝗮𝗻𝗰𝗲 𝘁𝗼 𝗣𝗿𝗲𝘃𝗲𝗻𝘁 𝗔𝗻𝗼𝘁𝗵𝗲𝗿 𝗖𝗿𝗶𝘀𝗶𝘀: An independent central bank can keep macroeconomic stability and confidence in the local currency as it can refuse to print money and can force the Treasury to take fiscal consolidation seriously. The professionals in Central Bank committees should be given a fixed term to make long-term policy decisions on interest rates and reserve requirements without political interference

𝗔𝗱𝗱𝗿𝗲𝘀𝘀𝗶𝗻𝗴 𝗖𝗼𝗺𝗽𝗲𝘁𝗶𝘁𝗶𝘃𝗲𝗻𝗲𝘀𝘀 𝗖𝗼𝗻𝘀𝘁𝗿𝗮𝗶𝗻𝘁𝘀 𝗮𝗻𝗱 𝗚𝗼𝘃𝗲𝗿𝗻𝗮𝗻𝗰𝗲 𝗜𝘀𝘀𝘂𝗲𝘀 𝗣𝗼𝘀𝗲𝗿 𝗯𝘆 𝗦𝗢𝗘𝘀: The recent SOE Reform Policy approved by the cabinet, maps out a comprehensive approach to restructure and divest commercial SOEs and SOBs. Successful implementation will require extensive engagement with stakeholders and mobilization of high-quality expertise .

𝗥𝗲𝗳𝗼𝗿𝗺𝘀 𝘄𝗶𝘁𝗵 𝗔𝗰𝘁𝘂𝗮𝗹 𝗜𝗺𝗽𝗹𝗲𝗺𝗲𝗻𝘁𝗮𝘁𝗶𝗼𝗻𝘀: Continue to strengthen the country’s social protection system to improve coverage and enhanced protection of the poor and vulnerable, including from future shocks.

𝗘𝗳𝗳𝗶𝗰𝗶𝗲𝗻𝘁 𝗧𝗮𝘅 𝗖𝗼𝗹𝗹𝗲𝗰𝘁𝗶𝗼𝗻: Instead of merely increasing taxes, the government should widen the tax base and implement a system to efficiently collect taxes.

𝗜𝗺𝗽𝗿𝗼𝘃𝗶𝗻𝗴 𝗙𝗼𝗿𝗲𝘅 𝗘𝗮𝗿𝗻𝗶𝗻𝗴 𝗖𝗮𝗽𝗮𝗰𝗶𝘁𝘆: Sri Lanka has to improve its forex earning capacity in order to achieve debt sustainability. Fiscal consolidation is needed as a medium-term measure, but the reforms should be extended to eliminate the country’s anti-export and anti-FDI biases.

Contributors:

Tahrima Bhuiyan (Co-ordination)

Sirazum Munira Raiyan (Research)

Rakib Hasan Zenith (Research)

Ariful Hasan Shuvo (Design)

References:

- Sri Lanka External Debt, 2012 – 2023 | CEIC Data

- https://www.treasury.gov.lk/api/file/a7db93c9-70a2-46b7-932f-dc92643865c9

- ঋণের বোঝা বেড়ে খাদের কিনারে শ্রীলংকা (bonikbarta.net)

- China offers Sri Lanka a 2-year debt moratorium (cnbc.com)

- Finance News: Latest Financial News, Finance News today in Bangladesh (thefinancialexpress.com.bd)

- https://www.tbsnews.net/bangladesh/sri-lanka-pay-200-million-loan-bangladesh-45-million-interest-705654?amp

- Towards Sri Lanka’s Recovery: Green, Resilient and Inclusive Development (worldbank.org)

- How Sri Lanka Can Overcome Its Economic Crisis – The Diplomat

- What lies behind Sri Lanka’s collapse? | LSE Business Review

- Sri Lanka’s Economic Meltdown – What happened? (visionofhumanity.org)

- SRI LANKA DEVELOPMENT UPDATE (worldbank.org)

- Sri Lanka: Why is the country in an economic crisis? – BBC News